Listen To This Article

Colder Winter May Fuel Reverse Mortgage Demand

For many homeowners, monthly housing costs are predictable. Property taxes and insurance may creep up over time, but those increases are spread out over 12 months. One expense, however, can be wildly unpredictable—home heating. And for retirees living on a fixed income, a harsh winter can quickly turn a manageable budget into a financial strain.

After living in the South for 30 years, I grew accustomed to mild winters and modest heating bills. The trade-off, of course, was higher air-conditioning costs. Now, after surviving my third winter back in the Northeast, I’m not sure which hurts more: the sub-zero wind chills or the heating bills that come with them.

This winter has offered a stark reminder of how quickly energy costs can spike. Natural gas prices doubled in recent days as colder weather swept across much of the country. According to the U.S. Energy Information Administration, “This weekend [January 24–25, 2026], much of the country is expected to experience severe winter weather. When cold weather hits, especially over a large swath of the country, we often see increased energy demand for space heating, in turn raising demand for both electricity and natural gas.”

Unfortunately, utilities are just one example of the unexpected expenses that can disrupt a retiree’s monthly cash flow. Medical costs, increased grocery prices, and home repairs have a way of showing up unannounced. The question is not if surprises will happen, but how homeowners will pay for them.

The Reverse Mortgage Solution

Many older homeowners fail to recognize how effectively home equity can be used to stabilize an otherwise volatile retirement. The federally insured reverse mortgage, known as a Home Equity Conversion Mortgage (HECM), allows homeowners age 62 and older to access a portion of their home’s value without taking on a required monthly principal and interest mortgage payment.

Two HECM strategies are particularly well-suited for managing rising and unpredictable expenses like heating costs:

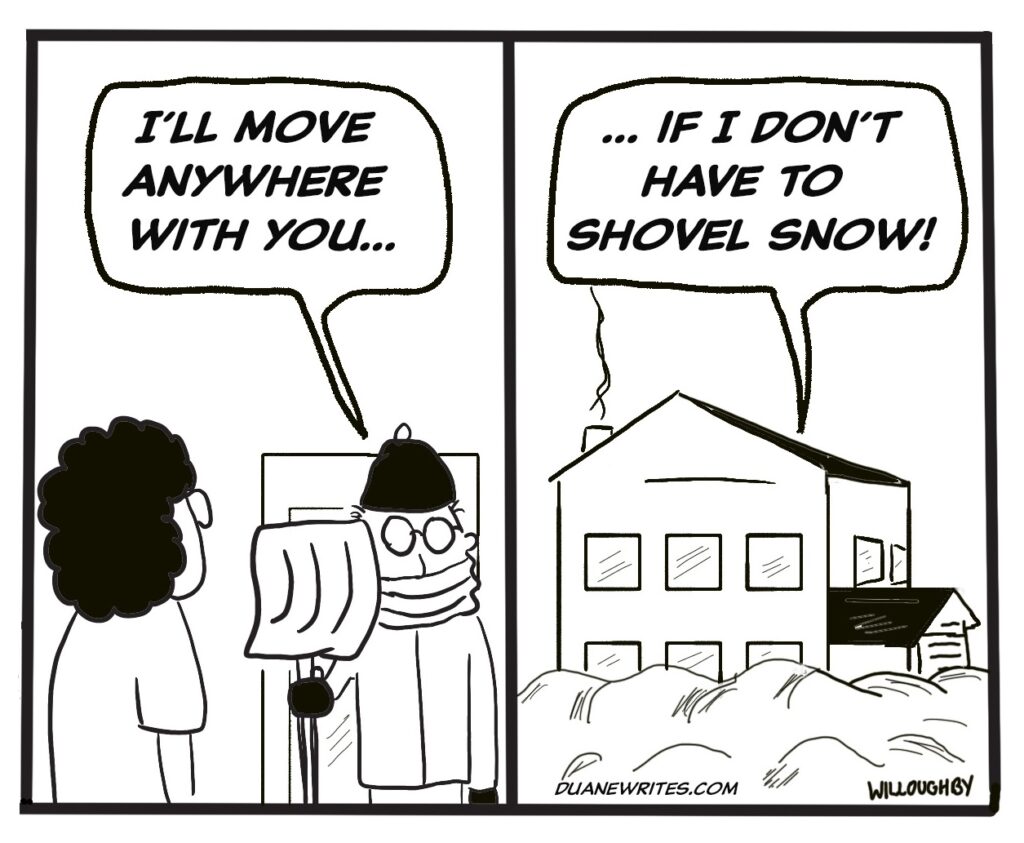

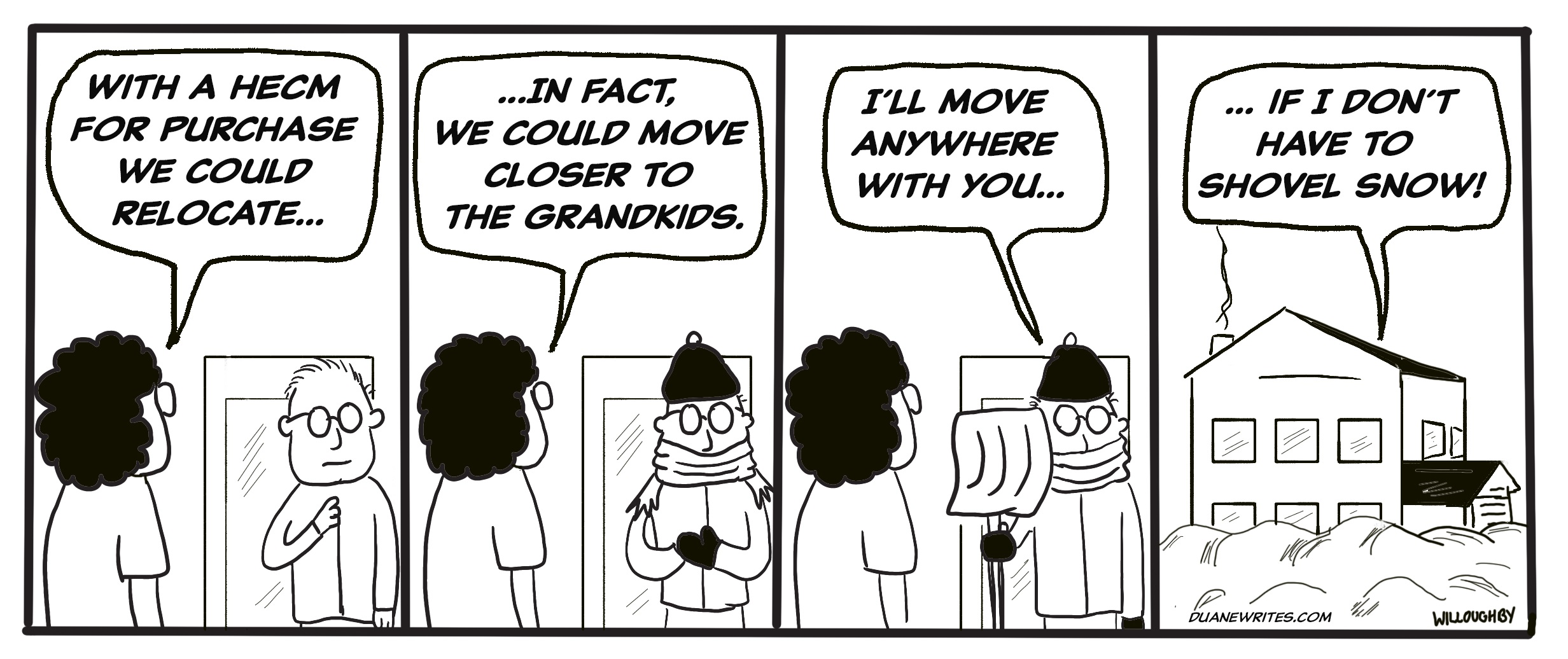

1. Relocate Using a HECM for Purchase

If seasonal expenses tied to an existing home become overwhelming, relocation may be the smarter long-term solution. A HECM for Purchase allows homeowners to downsize or move to a more efficient property while still benefiting from a reverse mortgage. This approach can increase liquidity, reduce ongoing living expenses, and improve overall cash flow.

2. Establish a HECM Line-of-Credit (LOC)

A HECM is generally structured with a line-of-credit that increases over time. This line-of-credit can be established early in retirement and tapped later to cover unexpected expenses, such as a brutal winter’s heating bills. By using home equity strategically, retirees can preserve other assets and avoid disrupting their broader retirement plan.

Whether relocating with a HECM for Purchase or refinancing with a HECM line-of-credit, reverse mortgages give older homeowners a powerful way to stay financially resilient so they can weather any winter storm.