ANSWERS AI

Chat with an AI trained on reverse mortgage FHA guidelines, sales strategies, and even the eCFR Title 24 — and get reliable answers in seconds.

What Does ANSWERS AI provide?

Regulatory Clarity

Instant access to HUD guidelines and US Code of Federal Regulations references

Sales Know-How

Real-world techniques and insider coaching, built in

Backed by Sources

Every answer cites source materials including Understanding Reverse and Navigating Reverse

Secret Sauce

REVERSE plus trained a custom AI using select reverse mortgage sources, so you get accurate, relevant answers based strictly on trusted materials.

Whenever possible, the AI includes exactly where the answer came from — like the document name, section number, and even paragraph reference — so you can trust the response and back it up.

Scroll down to explore the core sources used by ANSWERS AI.

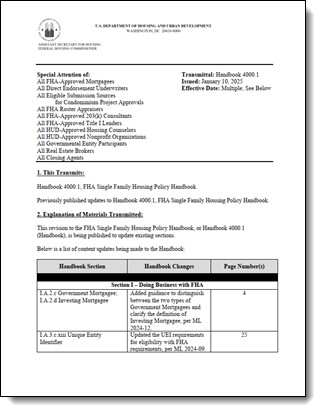

HUD’s 4000.1 Handbook

FHA Single Family Housing Policy Handbook

Note that we only tap into those sections specific to reverse mortgages.

CFR Title 24 Section 206

CFR Title 24 is one of fifty titles comprising teh US Code of Federal Regulations containing the principal set of rules and regulations issued by federal agencies regarding housing and urban development.

Note that we only tap into those sections specific to reverse mortgages.

BOOK: Understanding Reverse

Simplifying the Reverse Mortgage

Dan Hultquist

BOOK: Navigating Reverse

The Essential Reverse Mortgage Guide for Borrowers, Spouses, and Heirs

Dan Hultquist

Navigating Reverse is the only book written specifically for existing reverse mortgage borrowers, surviving spouses, heirs, and trusted advisors. If you have a reverse mortgage or are working with someone who does, this is an indispensable resource.

How It Works

Monthly Subscription

No long term contracts required.

Included with your ANALYZER PRO subscription.

Access Content Online

ANSWERS AI is a browser-based application that works on a desktop, a tablet, and all mobile devices.

Suggested Questions

Automatically generates follow-up questions for you to dig into.