Listen To This Article

The 2025 Big Beautiful Bill brought several important updates to the tax code. For homeowners with a federally insured reverse mortgage—known as a Home Equity Conversion Mortgage (HECM)—the biggest news is that the Mortgage Insurance Premium (MIP) deduction has been renewed and made permanent.

Now, you might be thinking: “But wait… reverse mortgage borrowers don’t make payments. So why would they care about deductions for payments they don’t even make?”

That question explains why many loan originators struggle to sell reverse mortgages. They often focus only on homeowners who have no interest—or no ability—to make payments.

The truth is, HECM borrowers can make voluntary payments, and doing so can provide real financial advantages. One of the biggest benefits is the ability to take advantage of itemized deductions in years when it benefits them most.

Of course, the next thought is usually: “But retirees can’t afford big mortgage payments—they need their cash for living expenses and emergencies.”

Not true!

With the adjustable-rate HECM, any payment a homeowner makes not only reduces the loan balance but also increases the available line of credit dollar-for-dollar. In other words, there’s no loss of liquidity. Instead, the borrower gains the flexibility of a growing, guaranteed credit line they can access anytime.

HOW DOES A REVERSE MORTGAGE TAX DEDUCTION WORK?

When a homeowner makes voluntary payments with a HECM, the money is typically applied in this order:

- Mortgage Insurance Premiums (both initial and accrued)

- Accrued interest

- Principal borrowed

If payments in a calendar year total more than $600, the loan servicer will send an IRS Form 1098. That form is the ticket to potentially claiming a mortgage-related tax deduction.

EXAMPLE:

Meet Jack. He’s 62 and takes out a reverse mortgage to pay off his $300,000 traditional mortgage—the loan he originally used to buy his home.

Instead of continuing to make monthly payments, Jack decides to make optional payments every four years over the next 20 years. Those payments cover both mortgage insurance and accrued interest.

This strategy lets him “stack” deductions in those years, maximizing his ability to itemize when it really counts.

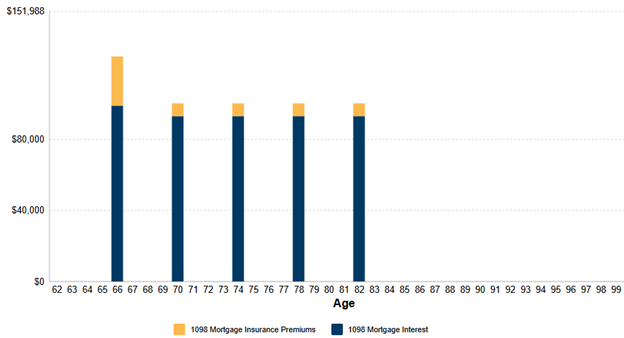

And here’s the exciting part: with the REVERSE plus ANALYZER, we can now model the IRS Form 1098 Jack would receive—showing both MIP and interest paid. The chart below illustrates this strategy:

Now, the crazy part: By the time Jack makes his fifth optional payment at age 82, his secure line of credit has grown to more than $1 million.

CONCLUSION

HECMs aren’t just about eliminating required payments. They’re about giving retirees more control, choice, and tax-smart flexibility than most people realize.

To see this technology demonstrated, please contact us.

Notes

- With this strategy, the first payment is generally larger because it includes the Initial Mortgage Insurance Premium (IMIP).

- Mortgage insurance is deductible for tax year 2026 and beyond, but not retroactive.

- While we can model the receipt of an expected IRS Form 1098, only a tax professional should provide guidance on actual deductibility.