Reverse News & Views

News, training, stories, and insights shaping the Reverse Mortgage industry

Sign up to receive an email whenever a new Article gets posted to this News & Views site.

It is free, and you can cancel at any time.

•

Clarifying the Reverse Mortgage Occupancy Requirements

Many homeowners are incorrectly told that leaving their home for a certain number of days will jeopardize a reverse mortgage. In reality, occupancy rules are more flexible. As long as the home remains the borrower’s principal residence and the servicer is notified of extended absences, the loan can remain in good standing.

•

Colder Winter May Fuel Reverse Mortgage Demand

Rising winter heating costs can strain retirees on fixed incomes, exposing gaps in monthly cash flow. This summary explains how higher utility bills may drive interest in reverse mortgages, especially HECMs, as a way to access home equity, manage unexpected expenses, and preserve long-term financial stability.

•

How Can a Reverse Mortgage End in Foreclosure?

It’s possible to have a foreclosure with a reverse mortgage… but not for the reason most people assume. Reverse mortgages have no required monthly principal and interest payment, so they don’t default for the traditional “missed payment” reason.

So why would a foreclosure happen? Read the article to find out.

•

Why do Reverse Mortgages have two rates?

Reverse mortgages, particularly adjustable-rate HECMs, are structured with two interest rates. The “expected rate” is used to determine the initial loan amount at closing. The “note rate” applies after closing and controls how interest builds over time and how the available line of credit grows.

•

What is a HECM Limit? Why Does it Matter?

HUD has announced they raised the 2026 HECM Limit, giving many high-value homeowners access to more usable equity. This boost not only enhances potential proceeds but also opens the door for timely outreach to prospects who may now benefit from improved reverse mortgage options.

•

What is a Reverse Mortgage 95% Payoff?

The federally insured HECM is a non-recourse loan ensuring borrowers and estates never owe more than the home’s value at sale. Upon becoming Due and Payable, heirs may satisfy the debt for the lesser of the balance or 95% of appraised value, provided a post-death transfer of title occurs.

•

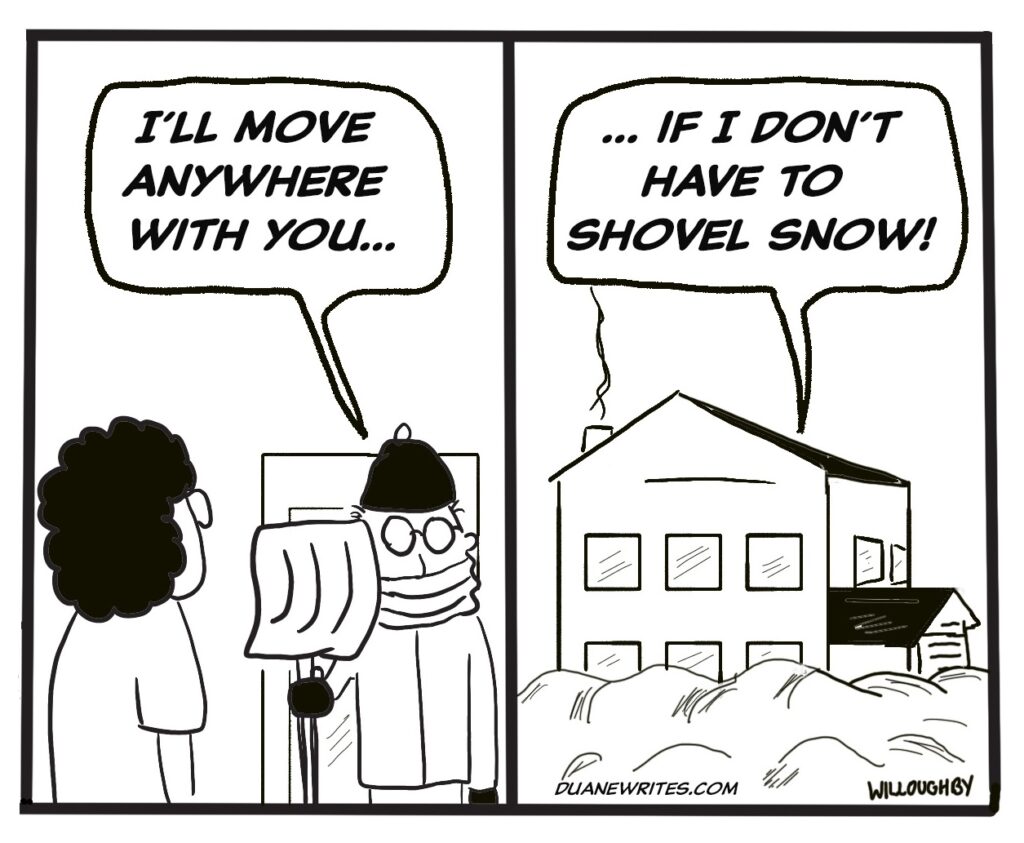

The Reverse Mortgage Timing Myth

For decades, homeowners were told to delay getting a reverse mortgage for as long as possible. But today the HECM program and today’s retiree have evolved. As Dan Hultquist explains, the strategic advantage of a reverse mortgage is often found at the beginning of retirement rather than the end. Establishing a HECM line of credit at age 62 provides years of compounding growth, protects future borrowing power from volatile interest rates and changing home values, and strengthens long-term financial planning. In a landscape filled with uncertainty, waiting can cost far more than acting early. This article outlines why earlier is often not just better but smarter.

•

Using Reverse Mortgages to Solve Complex Challenges

Today’s reverse mortgage borrower isn’t desperate—they’re strategic. More homeowners now use the federally insured HECM to support thoughtful financial planning, from relocating in retirement to managing major life transitions. The HECM for Purchase helps buyers 62+ move without taking on monthly mortgage payments. Reverse mortgages also provide practical solutions for silver divorce, enabling fair buyouts while preserving stability. And because HECM proceeds aren’t taxable, retirees can lower their tax burden by drawing income from home equity. A growing line of credit can even help fund rising in-home care costs.

Modern reverse mortgages are more versatile than most realize.

•

Clarifying Non-Borrowing Spouse Guidelines

When a borrower has a younger spouse, reverse mortgage rules can get complicated fast. HUD’s protections for Non-Borrowing Spouses have come a long way since 2014, but the nuances still trip up even experienced originators. In this article, we break down why NBS rules exist, how FHA’s Eligible vs. Ineligible designations actually work, and what it all means for long-term housing security. If you want to give clients clarity — and avoid surprises at closing — this is essential reading.

•

An Honest Discussion about HECM Mortgage Insurance

FHA insurance makes the HECM reverse mortgage possible — offering borrowers security, flexibility, and lifetime protection. But while the product’s value easily justifies its cost, the current insurance structure doesn’t. Today’s 2% upfront premium is too heavy for low-draw borrowers, while ongoing costs remain too light. Dan Hultquist argues that a smarter balance — lowering the upfront charge and slightly increasing the ongoing premium — would make HECMs more accessible, sustainable, and fair for everyone involved.