Listen To This Article

Many homeowners open a reverse mortgage to tap into their home equity when they need it. Most choose a Home Equity Conversion Mortgage (HECM) — and for good reason: the unused portion of the line of credit (LOC) grows over time at the same rate as the loan balance.

What many don’t realize is that this growing credit line isn’t just sitting there — it can be converted into steady monthly income at any time. And here’s the kicker: the cost to make that switch is just $20.

This powerful strategy is known as an LOC conversion, and it can be a game-changer for your retirement income plan.

WHAT HAPPENS DURING AN LOC CONVERSION?

As the credit line grows, the available pot of money gets bigger. Meanwhile, as you age, your life expectancy shortens — so that larger pot can be converted into cash over a smaller expected time frame.

The result? Bigger monthly payouts. This is similar to delaying Social Security — the longer you wait, the more you get on a monthly basis.

- TENURE payout: Monthly payments continue for as long as the loan is in good standing.

- TERM payout: Monthly payments are made over a specific number of months or years, then stop — though the loan itself continues.

WHY CONVERT AN LOC?

Financial planners often recommend setting up the HECM line of credit early — as soon as age 62 — but waiting to convert it into monthly payments. Why? Because time works in your favor.

Here are two common scenarios:

- Income replacement: A surviving spouse can convert the LOC to a tenure payout to replace lost income in perpetuity.

- Long-term care: If home care is needed down the road, the borrower can “flip the switch” to a 5-year term (or any term that fits), instantly turning stored equity into cash flow.

A SIMPLE EXAMPLE

Meet Bill.

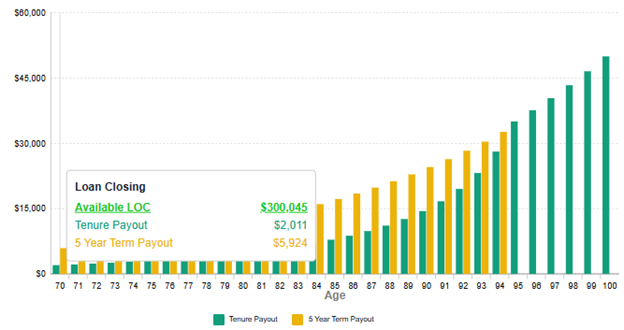

At age 70, he qualifies for a $300,000 HECM line of credit.

- Tenure payout: about $2,000 per month in perpetuity.

- 5-year term payout: about $5,900 per month.

- At age 80, his monthly payouts jump to $4,700 (Tenure), or $12,000 (5-year Term).

- At age 90, they soar to $14,400 (Tenure), or $24,500 (5-year Term).

That’s the power of letting the credit line grow before converting.

BOTTOM LINE

There’s a built-in incentive to delay LOC conversion. The longer the line of credit grows, the larger the monthly payouts become.

For many homeowners, that can mean meaningful cash flow later in life — whether to cover health expenses, home care, or simply to live more comfortably in retirement.